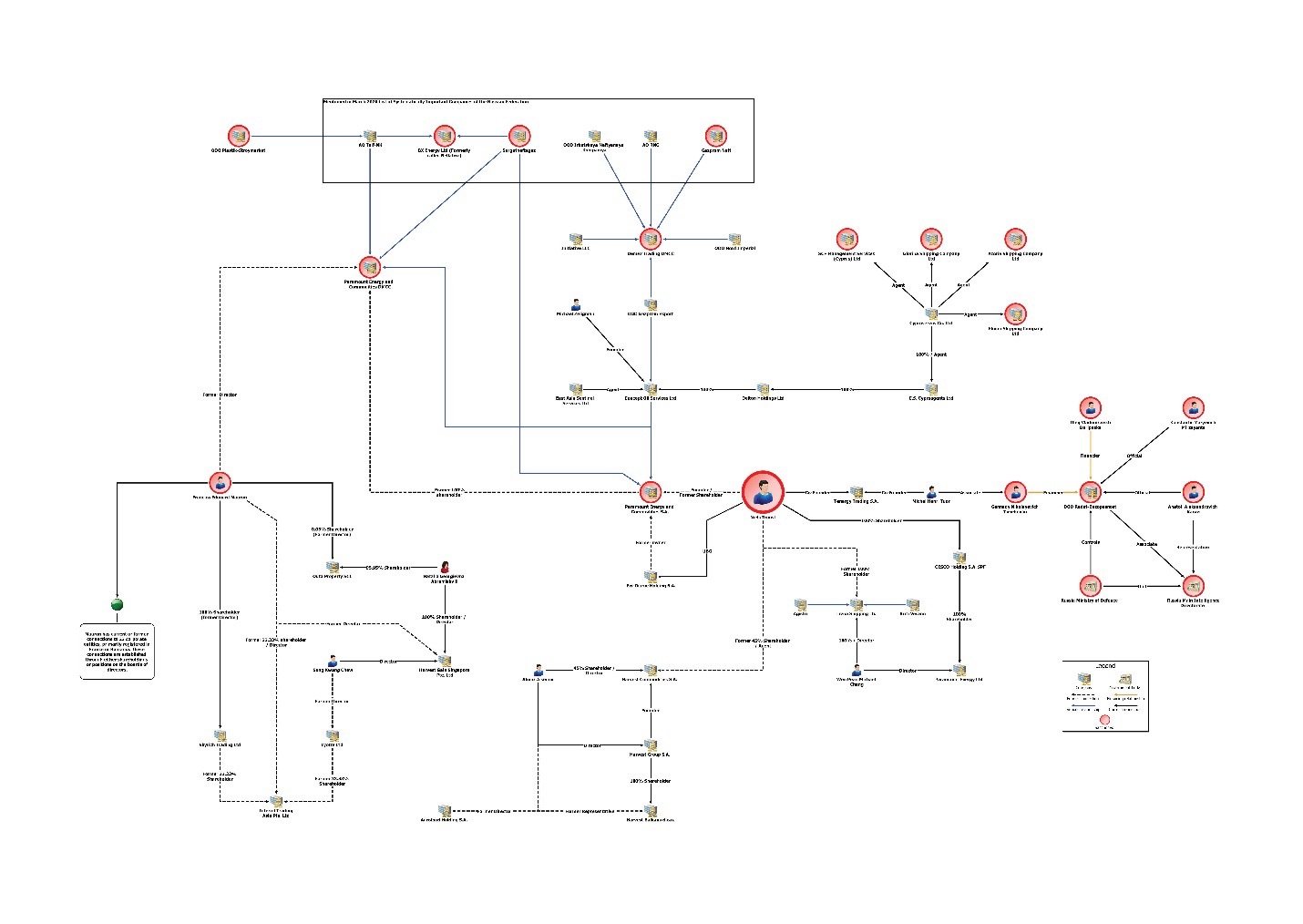

Russian-infused Ecosystem, Network, and Infrastructure

Evidence in the Paramount SA and Paramount DMCC ledgers further reveals Troost’s connections to Russian state-owned entities and shippers linked to the “Russian ghost fleet” to transport oil.

Neils Troost is a 55-year-old Dutch national and Swiss resident. Troost has long enjoyed privileged access to the Russian market with a long history — since at least the 1990s — of trading in Russian oil.[1] He developed his niche trade likely through the sponsorship of Gennady Timchenko, who likely created introductions first for Troost’s work with a Gunvor affiliate through Troost’s company Tenergy, and later to the Transneft executives associated with Concept Oil and Demex. allowing Troost to become an established and trusted actor in this space. He built a complex and opaque infrastructure in support of his trading empire, one that, following the Russian invasion of Ukraine, Russia would avail itself of to advance its interests.

After the outbreak of Russian hostilities in Ukraine, Troost moved the vast majority of his business from Geneva to the UAE, ultimately circumventing European and G7 restrictions on Russia oil trading. As Litasco, Vitol, and Trafigura withdrew from the market, documents from contemporaneous exchanges and the Paramount ledgers indicate that Paramount DMCC sought to fill the void and increase its trade of Russian oil. In 2022, Paramount DMCC traded 20B Dirhams of Russian Oil, approximately $5 Billion.

Confirmed Troost-owned Entities

EZI DIAROC SA[2]

CESCO Holding SA SPF[6]

Paramount Energy Limited (Hong Kong)[7]

Solas Capital Investment SARL

Solas International Terminals DMCC

SITMED FZCO

GTS Terminal (Turkey)

SITIQ FZCO

SITAF FZCO

Solas Vastgoed

Tenergy Trading SA

Suspected Troost-proxy Entities

Livna Shipping LTD [8]

Interoil Trading Asia PTE LTD (Singapore)[9]

Harvest Gain Singapore Pte Ltd[10]

Lyotre Limited (Hong Kong)[11]

Skyrich Trading Limited (Hong Kong)[12]

Mesa Energy Trading DMCC (UAE)[13]

Confirmed Customers:

China Oil (Hong Kong) Corporation Limited whose parent company is reportedly the state-owned China National Oil Corporation (CNPC) and was the consignee of a shipment from Gazprom Neft PJSC.

China National Offshore Oil Corporation Trading (Singapore) (CNOOC Singapore) is a Chinese state-owned company, reportedly part of an aviation fuel supply chain to Myanmar.

Qingdao New Refine Oil Trading Co. LTD was the 11th biggest buyer of Russian crude between January and September 2023 receiving shipments worth USD 3.17 billion in 2023. The two main suppliers listed are Gazprom Neft PJSC and Gazprom subsidiary Sakhalin Energy LLC.

Confirmed Suppliers:

According to the ledgers, Paramount SA and Paramount DMCC were primarily supplied by Concept Oil Services Ltd and Demex Trading Limited DMCC (“Demex”) [14].

On January 10, 2025, the Troost-affiliated entity, UAE-based Demex Trading Limited DMCC (“Demex”), was sanctioned by OFAC for having “bought over 700 shipments of crude oil and diesel fuel from Russia worth at least $8 billion in 2023.”[15] This is significant because according to the Paramount SA and DMCC ledgers, Demex was the principal supplier to Paramount DMCC. Demex greatly increased its trading in 2023 and it is likely that Paramount’s activity mirrored Demex’s just as it did historically.

Prior to the Russian invasion of Ukraine, the principal supplier to Paramount SA was Concept Oil SA.[16] According to Public Eye:

“The rapid rise of Concept Oil Services has not gone unnoticed. In 2020, according to Forbes, this structure rose to 11th position among the largest buyers of Russian crude oil, with a volume of 6.5 million tonnes (a little less than 47.7 million barrels), alongside giants like CNPC, Litasco and Total. In Geneva, an employee of a major trading house said he was approached, a few years ago, by the director of Concept Oil Services who offered him an oil deal. But, when asked to answer a KYC (Know Your Customer, a banking procedure to verify the identity of clients) questionnaire, the Latvian citizen who presents himself as the company's main shareholder refused to give the names of all the beneficial owners of the company. ‘At the time, we concluded that Concept Oil Services was controlled by Transneft executives’, he adds.”[17]

After the Russian invasion of Ukraine, according to the ledger, the principal supplier to Paramount DMCC was Demex. According to Public Eye, there is a strong likelihood that Demex is a successor to Concept Oil Services Ltd given that the wind-down of Concept Oil conversely mirrors the wind-up of Demex.[18] Ex-Transneft manager Mikhail Mezhenstev has worked for both Demex and Concept Oil underlining the proximity of the two companies.[19]

In addition, the Paramount DMCC ledger shows numerous transactions between Paramount DMCC and sanctioned entities in Russia, including:

St Petersburg Bank (Bank Saint-Petersburg Public Joint Stock Company was sanctioned by the US and UK in February 2023).[20]

Ingosstrakh Insurance Company (sanctioned by the UK in June 2024[21]) Ingosstrakh is the fourth biggest insurance supplier in the Russian Federation. The company has provided reinsurance services to tankers transporting Russian oil following the cessation of coverage by Western insurance companies.

Surgutneftegaz PJSC (US imposed sectoral sanctions on Surgutneftegaz in September 2014 and the UK and US imposed sanctions in January 2025.[22]) Surgutneftegaz is the fifth-largest private company and the third-largest oil company in Russia with strong links to Putin and his close ally Gennady Timchenko.

In addition, the ledger of Paramount DMCC activities show numerous transactions between Paramount DMCC and entities whose founders, owners or board members are sanctioned, including:

JSC TAIF-NK whose co-founders Albert Kashafovich Shigabutdinov ("Shigabutdinov") and Rustem Nurgasimovich Sulteev ("Sulteev") have been respectively sanctioned by the UK in November 2022, [23] and the European Union in December 2023[24]. TAIF-NK also "provides aviation fuel for the Russian Armed Forces." And reportedly also has links to Timchenko.[25]

Zarnestservice LLC is a subsidiary of and sales agent for Zarubezhneft, a state-owned oil company. Two of JSC Zarubezhneft's board members, Evgeniy Alekseyevich Murov[26] and Pavel Yurevich Sorokin[27], have been sanctioned by the US.

NNK OIL LLC (and its subsidiaries) is the parent company of several NNK Oil group companies, including NNK Orenburgneftegaz Llc, NNK Samaraneftegaz Llc, NNK Severnaya Neft Llc and NNK Nyaganneftegaz[28]. It is owned by Eduard Khudainatov who was sanctioned by the EU on 3 June 2022[29]. He is the former CEO of Russian state-owned oil company Rosneft and is reportedly also the proxy owner of superyachts belonging to Vladimir Putin, Suleiman Kerimov, and Igor Sechin.[30]

Network

Early in his career, Troost held a senior role in Taurus Petroleum Services Limited where he was individually named in a United Nations Report on Programme Manipulation concerning evasion of international sanctions on Iraqi oil trading (e.g. the Iraqi Food for Oil Scandal).[31] Troost also appears to have met Maurice Taylor during his time at Taurus, who had administered its Swiss headquarters[32]. Maurice Taylor would become the administrator for many of Troost-owned entities.[33]

Then in 2009, Troost co-founded Tenergy Trading SA, with Swiss energy trader Michel Tuor. Tenergy has traded oil products with International Petroleum Products, a firm owned by Timchenko, a longtime ally of Putin[34]. Also at the time, Tenergy was a well-known Gunvor affiliate, a multinational energy trading company also founded by Timchenko in 2000.[35]

According to reporting from Swiss investigative outlet Public Eye:

“[T]he founders of Paramount and Tenergy enjoyed a good relationship with Gennady Timchenko, co-founder of oil trading giant Gunvor and a close friend of Vladimir Putin. When this Russian billionaire was still living in Geneva, the duo was invited to his luxurious villa in Cologny, states a source… It is this proximity in particular that would have allowed their companies to establish themselves with such success on the Russian market. Another interlocutor, recalling that friendly relations with Timchenko, a prominent oligarch, unquestionably opens many doors in Russia, adds: “Not a single drop of oil is leaving Russia today without high-level approval, especially when it comes to such volumes".[36]

In 2011, Troost briefly served as a commercial director at Rosneft Trading – a subsidiary of the state-owned Rosneft.[37]

Paramount SA’s principal supplier was Concept Oil who bought from the Irkutsk oil company (INK), RNG, Gazprom Neft and Yargeo, a joint venture between Novatek and the Energia fund of former Russian energy minister Igor Yusufov.[38]

Timchenko is himself a shareholder of Novatek.[39] Concept Oil is believed to be controlled by Transneft executives”[40]

The exclusive shipper for Paramount SA and Paramount DMCC is Livna Shipping LTD.[41] Three of the vessels previously chartered by Livna[42] are ultimately owned by Sovcomflot, Russia’s state-owned shipping company which was sanctioned by the US in February 2024[43]. Data coming from the Anonymous hack of ALET, a Russian customs broker for fuel and energy companies, shows that Livna is often listed as an “agent” alongside a company called Altoprae Marine LLC (OOO). Altoprae Marine owned 12%, until the end of 2021, of OOO Epsilon, whose other shareholders were Mikhail Gennadievich Mezhentsev and Anna Mezhentseva. Mezhentsev is a known close associate of Michael Zeligman who is believed to be the managing director of Demex Trading Limited DMCC, a key supplier of Russian petroleum (and near exclusive supplier to Paramount DMCC) to West Africa since early 2023. According to an article in Africa Intelligence, Mehzentsev works with Igor Sechin, the CEO of Russia-owned oil company Rosneft, in West Africa. Mezhentsev is a former executive of oil pipeline operator Transnefteproduct, a subsidiary of the Russian state-owned Transneft group

In addition to his activities with Paramount SA and Paramount DMCC, Troost ramped up his activity with Harvest Commodities SA (according to Public Eye, previously Sun Oil SA) exporting significant amounts of Russian grain. Though he claims that he was focused on Ukrainian grain, only one instance could be found of Troost exporting Ukrainian grain while 90 instances of exporting Russian grain have been identified.[44] Troost’s partner in Harvest Commodities was Almaz Alsenov, owner of Harvest Group SA, and the two principal suppliers to Harvest Commodities SA and Harvest Group SA were Demetra Trading (until July 2022) and Grain Gates, companies which are closely related, according to Russian media.[45] Until July 2023, Demetra’s shareholders included the state-owned Russian bank VTB which has been subject to sanctions in the US, the EU and Switzerland since 2022[46]. Until August 2023, billionaire Alexander Vinokurov (the son-in-law of Russian Foreign Minister Sergei Lavrov), sanctioned himself[47], was also a shareholder of Demetra.[48]

Several former employees of Paramount have either previously worked for or are currently employed by Gunvor, Timchenko’s energy trading and logistics company, including Neil Hitchinson and Zeynep Ucar[49]. According to Turkish public records, Two Paramount employees are former directors of Global Terminal Services ("GTS"), which owns the Dortyol oil terminal in Turkey.[50] Troost was an indirect 40% shareholder of GTS between at least October 2022 and November 2023.[51]

[1] U.N. Report on Manipulation of the Oil-for-Food Programme by the Iraqi Regime, U.N. Indep. Inquiry Comm., 27 Oct. 2005, https://hrvoices.org/assets/attachments/documents/volcker_report_10-27-05.pdf.

[2] EZI DIAROC SA filing

[3] Paramount SA filing

[4] Paramount DMCC filing

[5] Harvest Commodities SA filing

[6] CESCO Holding SA SPF filing

[7] Owned via Troost entity CESCO Holding SA SPF. Paramount Energy Limited (Hong Kong) filing

[8] Until October 2018, Livna was owned 100% by Luxembourg-registered CESCO Holding SA SPF which in its 2018 (and prior) accounts listed Livna as a 100% subsidiary along with Hong Kong-registered Paramount Energy Limited and Luxembourg-registered Solas Capital Investments Sarl. Livna Shipping Ltd. CESCO’s articles of association from January 2014 confirm Troost as the founding 100% shareholder while Livna also appears in Paramount DMCC’s ledger data. In July 2018, Livna granted ING Belgium (Geneva Branch) a pledge “covering all claims and rights of the Bank against Paramount Energy SA”. Documentation. The sole shareholder of Livna since October 2018 has been the company’s sole director since incorporation, a Malaysian national called Michael Wen Pean Chang, who is likely a nominee and holds the shares on behalf of Troost given personal accounts and ledger activity (see below). Chang also serves as the sole director of Hong Kong-registered Paramount Energy Limited.

[9] According to the Singaporean corporate registry, Interoil Trading Asia was incorporated on 18 September 2009 and remains active. It is formerly known as Odyssea Consulting Pte Ltd and is registered to 7 Temasek Boulevard, 43-01A, Suntec Tower One. Interoil Trading Asia filing. An April 2019 piece by Energy Intelligence suggests that Interoil Trading Asia is the Singapore-based representative office for Paramount Energy and Tenergy. (NEFTE Compass 4 April 2019, Energy Intelligence Group). (Tenergy was Troost’s first company that worked almost exclusively with Gunvor). According to an archived version of Tenergy Trading’s website, they had an affiliate company representative office in Singapore called Interoil Trading Asia. https://web.archive.org/web/20180916205026/https://tenergytrading.ch/contact/

[10] From Russian Oil to Grain: The Strange Conversion of a Geneva-based Trader, PublicEye, Dec. 13, 2024, https://www.publiceye.ch/en/topics/soft-commodity-trading/from-russian-oil-to-grain-the-strange-conversion-of-a-geneva-based-trader, stating: “Harvest Gain Singapore Pte. Ltd. (“Harvest Gain Singapore”) likely connected to Harvest Commodities and Troost. The current director and shareholder of Harvest Gain Singapore is Natalia Abramishvili. In the Singapore corporate registry, Abramishvili is registered as a national of St Kitts and Nevis and is married to Cyril Surikov, a Russian national. Harvest Gain Singapore Pte Ltd filing Abramishvili currently serves as the director of SCI Outa Property (“Outa Property”), a France-incorporated company, along with Francois Mauron and his wife Karin Ruth Mauron. SCI Outa Property filing Francois Mauron has served as a proxy for Troost on numerous occasions. Notably, one of Harvest Gain Singapore’s former directors is Sung Kwang Chew (“Chew”), a well-known Singaporean oil trader who has no ostensible experience in the grain industry. Chew has historical connections to Troost, serving as a director of Interoil Services Asia Pte. Ltd. (“Interoil Services Asia”), a Singapore-domiciled company that was an affiliate of Tenergy, another of Troost’s previous firms.”

[11] Lyotre Limited (former Interoil Trading Asia shareholder owned by Troost associate). According to the Hong Kong corporate registry, Lyotre is an active entity that was incorporated on 19 April 2010. A filing dated 19 May 2024, states that the current sole shareholder is Bahamian entity L.B. Corporate Services with the shares having been transferred from Francois Mauron on 21 March 2024. Mauron had become the sole shareholder of Lyotre on 18 December 2023, following the transfer from BVI-registered Portman Nominees S.A, which had been the sole shareholder since at least 2014. Lyotre Limited filing According to the UK corporate registry, the Swiss entity Portman Nominees SA has Ariane Slinger as its beneficial owner. The 2024 registry filing also indicates that the Lyotre director is Odilo Javier Otero Gomez, a Swiss-Spanish dual national residing in Switzerland, who has held the position since 2011. He is likely to be a nominee director as he is linked to dozens of entities in offshore jurisdictions. Intermittent directors of Lyotre are Chew and Ariane Slinger, a Dutch citizen residing in Switzerland. Records show that BVI-registered S.O. Clover Management acted as director from incorporation until May 2022. Lyotre’s registered address, which is Room 102, 1st Floor, Block A, Sea View Estate, 2-8 Watson Road, North Point, Hong Kong, is that of its secretary, Credit Secretaries Limited.

[12] According to a March 2018 document relating to Luxif SICAV-SIF, a Luxembourg investment fund, Skyrich Trading Limited was represented by Swiss national Francois Mauron, a Troost proxy. Skyrich’s registered address is 2503 Bank of America Tower, 12 Harcourt Road, Hong Kong. Skytrich filing.

[13]Mesa Energy is a UAE company focused on trading refined oil products. Mesa Energy filing. In 2023, JSC TAIF-NK delivered gas oil from Russia to Mesa Energy. The Paramount ledger shows that Paramount DMCC made two payments to Mesa Energy. Francois Mauron is the sole shareholder of Mesa Asset Management Limited (“Mesa Asset Management”), a Dubai-based entity registered on 1 November 2023. This company appears to be related to Mesa Energy Trading DMCC.

[14] According to the ledgers, Demex (and its likely predecessor Concept Oil) was the primary supplier to Paramount DMCC.

[16] According to Public Eye, “In August 2020, the specialised agency Argus indicated that Paramount partnered with Concept Oil Services, a company in Hong Kong, also active in the port of Kozmino. This “intermediary buys small volumes to fill tankers and sells them to its partner Paramount Energy. The main volumes of Concept Oil Services are bought from the Irkutsk oil company (INK), RNG, Gazprom Neft and Yargeo, a joint venture between Novatek and the Energia fund of former Russian energy minister Igor Yusufov. Gennady Timchenko is himself a shareholder of Novatek.” The Excellent Russian Connections of a Small Geneva Trader, PublicEye, Apr. 5, 2022, https://www.publiceye.ch/en/topics/ukraine/commodity-trading-with-russia/the-excellent-russian-connections-of-a-small-geneva-trader.

[17] The Excellent Russian Connections of a Small Geneva Trader, Public Eye, Apr. 5, 2022, https://www.publiceye.ch/en/topics/ukraine/commodity-trading-with-russia/the-excellent-russian-connections-of-a-small-geneva-trader. The Latvian in question is likely Michael Zeligman, the presumed manager of Concept Oil and then Demex.

[18] Russian Oil Trade: Dubai Pulls Out All the Stops to Edge Out Switzerland, Public Eye, Nov. 21, 2023, https://www.publiceye.ch/en/topics/commodities-trading/russian-oil-trade-dubai-pulls-out-all-the-stops-to-edge-out-switzerland

[19] Russian Oil Trade: Dubai Pulls Out All the Stops to Edge Out Switzerland, Public Eye, Nov. 21, 2023, https://www.publiceye.ch/en/topics/commodities-trading/russian-oil-trade-dubai-pulls-out-all-the-stops-to-edge-out-switzerland

[20] BANK SAINT-PETERSBURG PJSC, OpenSanctions, https://www.opensanctions.org/entities/NK-LiC5dhcEL8RisKzEMDwv6q/ (last updated Mar. 3, 2025).

[21] INGOSSTRAKH INSURANCE COMPANY, OpenSanctions, https://www.opensanctions.org/entities/NK-ksWdCQnukA3VEELtfhANp2/ (last updated Feb. 27, 2025).

[22] Surgutneftegas, OpenSanctions, https://www.opensanctions.org/entities/NK-gyXAZAjfijNDV3fHyi8HTR/ (last updated Feb. 24, 2025).

[23] Albert Kashafovich SHIGABUTDINOV, OpenSanctions, https://www.opensanctions.org/entities/Q65152870/.

[24] Rustem Nurgasimovich SULTEEV, OpenSanctions, https://www.opensanctions.org/entities/Q55759794/ (last updated Jan. 25, 2025), COUNCIL DECISION 2014/145/CFSP, Off. J. E.U., Mar. 17, 2014, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A02014D0145-20240914

[25] Rustem Sulteev, Forbes, https://www.forbes.com/profile/rustem-sulteev/ (last updated Mar. 7, 2025).

[26] Evgeny Murov, OpenSanctions, https://www.opensanctions.org/entities/Q4308139/ (last updated Jan. 25, 2025).

[27] Pavel Yurevich Sorokin, OpenSanctions, https://www.opensanctions.org/entities/NK-dmNXGgBu3gEYniGbyQgFG3/ (last updated Feb. 23, 2025).

[28] ООО "ННК-ОЙЛ", OpenSanctions, https://www.opensanctions.org/entities/NK-VqZymKjDJ3euDhZTBNtsdb/ (last updated Dec. 22, 2023).

[29] Eduard Yurevich KHUDAYNATOV, OpenSanctions, https://www.opensanctions.org/entities/Q4502077/ (last updated Feb. 24, 2025); Eduard Yurevich KHUDAYNATOV, EU Sanctions Tracker, June 3, 2022, https://data.europa.eu/apps/eusanctionstracker/subjects/140928

[30] Meet The Russian Billionaire Who's The Proxy Owner Of Putin's $500 Million Yacht, Forbes, Jan. 7, 2023, https://www.forbes.com/sites/giacomotognini/2022/06/13/meet-the-russian-billionaire-whos-the-proxy-owner-of-vladimir-putin-500-million-yacht-eduard-khudainatov/

[31] U.N. Report on Manipulation of the Oil-for-Food Programme by the Iraqi Regime at p.130-143, 607, U.N. Indep. Inquiry Comm., 27 Oct. 2005, https://hrvoices.org/assets/attachments/documents/volcker_report_10-27-05.pdf

[32] Switzerland Investigates Trading Companies, Global Policy Forum, Jan. 31, 2004, https://archive.globalpolicy.org/security/oil/2004/0131swissoil.htm

[33] (see link chart)

[34] Little-Known Commodity Traders Help Russia Sell Oil, WSJ, May 27, 2022, https://www.wsj.com/articles/little-known-commodity-traders-help-russia-sell-oil-11653643583

[35] Refining, Energy Intelligence, Mar. 28, 2012, https://www.energyintel.com/0000017b-a7c1-de4c-a17b-e7c3c54d0000

[36] The Excellent Russian Connections of a Small Geneva Trader, PublicEye, Apr. 5, 2022, https://www.publiceye.ch/en/topics/ukraine/commodity-trading-with-russia/the-excellent-russian-connections-of-a-small-geneva-trader.

[37] Refining, Energy Intelligence, Mar. 28, 2012, https://www.energyintel.com/0000017b-a7c1-de4c-a17b-e7c3c54d0000

[38] The Excellent Russian Connections of a Small Geneva Trader, PublicEye, Apr. 5, 2022, https://www.publiceye.ch/en/topics/ukraine/commodity-trading-with-russia/the-excellent-russian-connections-of-a-small-geneva-trader.

[39] The Excellent Russian Connections of a Small Geneva Trader, PublicEye, Apr. 5, 2022, https://www.publiceye.ch/en/topics/ukraine/commodity-trading-with-russia/the-excellent-russian-connections-of-a-small-geneva-trader.

[40] The Excellent Russian Connections of a Small Geneva Trader, PublicEye, Apr. 5, 2022, https://www.publiceye.ch/en/topics/ukraine/commodity-trading-with-russia/the-excellent-russian-connections-of-a-small-geneva-trader.

[41] According to the Paramount ledgers.

[42] New Oil Traders Fill Void as Top Names Abandon Moscow Ties, Bloomberg News, May 17, 2022, https://www.bloomberg.com/news/articles/2022-05-17/new-oil-traders-fill-the-void-as-top-names-abandon-moscow-ties; Russia’s New Oil Routes: The Mysterious Traders Filling the Gap, Intelligence Online, Nov. 29, 2024, https://www.intelligenceonline.com/international-dealmaking/2024/11/29/russia-s-new-oil-routes-the-mysterious-traders-filling-the-gap,110345872-eve

[43] Sovcomflot, OpenSanctions, https://www.opensanctions.org/entities/NK-EL5cFqL5pRrFRBSUjny38g/ (last updated Mar. 1, 2025).

[44] The Excellent Russian Connections of a Small Geneva Trader, PublicEye, Apr. 5, 2022, https://www.publiceye.ch/en/topics/ukraine/commodity-trading-with-russia/the-excellent-russian-connections-of-a-small-geneva-trader.

[45] The Excellent Russian Connections of a Small Geneva Trader, PublicEye, Apr. 5, 2022, https://www.publiceye.ch/en/topics/ukraine/commodity-trading-with-russia/the-excellent-russian-connections-of-a-small-geneva-trader.

[46] VTB Bank, OpenSanctions, https://www.opensanctions.org/entities/NK-hErpKj3RZPtzUehfN7mgTa/ (last updated Mar. 4, 2025).

[47] Alexander Semenovich VINOKUROV, OpenSanctions, https://www.opensanctions.org/entities/Q28497287/ (last updated Jan. 25, 2025).

[48] Marathon Group sells stake in Demetra Holding, Interfax, Aug. 11, 2023, https://interfax.com/newsroom/top-stories/93470/

[49] Gunvor's head of crude oil trading Roulon leaves firm, sources say, Reuters, Jan. 28, 2025, https://www.reuters.com/business/energy/gunvors-head-crude-oil-trading-roulon-leaves-firm-sources-say-2025-01-28/; Market Review: Q3 2023. Back to Normal?, HC Group, 2023, https://media.journoportfolio.com/users/13662/uploads/f8046443-ae5a-4f72-a729-a28ca95fa365.pdf

[50] Turkish public record filings

[51] The Turkish Terminal Helping Disguised Russian Oil Reach Europe, FT, Jan. 30, 2024, https://www.ft.com/content/e5be1cac-3901-4066-a036-f78546b55eaf. FT reports that an agreement on the investment was reached in July 2022 but documentary evidence suggests the share sale did not complete until October 2022.